orange county ny tax deed sales

Orange County Property Records are real estate documents that contain information related to real property in Orange County New York. Tax Lien Certificates - Tax Deed Sales.

Make Money With Tax Liens Know The Rules Ted Thomas

Currency only paid in person at the Office of the Treasurer-Tax Collector in the County Service Center located at 601 N.

. Please mail completed forms and supporting documentation to. Ad Property Deed Info. County of Orange.

A real property transfer formRP-5217 RP-5217-NYC or RP-5217-PDF pilot projectis required for all real property transfers where a deed is filed. Name Orange County Recorder of Deeds Address 4 Glenmere Cove Road Goshen New York 10924 Phone 845-291-2690 Fax 845-291-2691. Property Removal List L.

Newburgh 34-1-132 W of County Highway 28 60 x 88 vacant land Newburgh CSD 500 2008. Again in New York you can prevent the loss of your home to a tax foreclosure by redeeming it. Ad Find Tax Foreclosures Under Market Value in For_Sale.

14 for counties that have sales but in New York City liens are not sold to the general public. Orange County Treasurer-Tax Collector. To redeem the property youll have to pay the amount of the delinquent tax lien or liens including all charges authorized by law before the redemption period expires.

5 2022 Orange County Tax Foreclosure Auction. Internet Property Tax Auction. The Orange County Tax Collector uses the In Rem method of foreclosure in accordance with North Carolina General Statute 105-375After the Tax Office has exhausted all other means of collection properties are seized and then auctioned off.

Here is a summary of information for tax sales in New York. The Orange County New York sales tax is 813 consisting of 400 New York state sales tax and 413 Orange County local sales taxesThe local sales tax consists of a 375 county sales tax and a 038 special district sales tax used to fund. Orange County New York Delinquent Tax Sale In New York the County Tax Collector will sell Tax Deeds to winning bidders at the Orange County Tax Deeds sale.

Find Orange County Property Records. For actual delinquent taxes please call OC Finance Tax Dept at 845291-2480 with TOWN and SBL. By law the Auditor-Controller cannot issue a check for payment of an approved claim until 90 days following the action taken by CountyCounsel if multiple claims are received.

These records can include Orange County property tax assessments and assessment challenges appraisals and income taxes. The latest sales tax rate for Orange County NY. Typically once a year between August and November Orange County holds a Deed Sale Auction.

Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. May 5 2022 11AM Bidding Opens Monday May 2 10AM Location. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Orange County NY at tax lien auctions or online distressed asset sales.

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the property owner. Business Tax Information Center The Business Tax Information Center can be reached by calling 800-972-1233. Generally the minimum bid at an Orange County Tax Deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property.

SALE PENDING SALE PENDING SALE PENDING SALE PENDING. In New York NY. The state and counties and agencies and officers thereof are exempt from the filing fee pursuant to section 8017 of the Civil Practice Law and Rules.

Search our database of Orange County Property Auctions for free. Registration and advance deposits are required to participate in the online auction. Co Excess Proceeds Claims.

The Orange County Sheriffs Department. Ad Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. Foreclosure Sales not to be confused with Tax Deed Sales are conducted by the Orange County Clerk of Courts located at.

HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings. Page 1 of 3 4152022. Information concerning Tax Deed sales may be obtained by using the RealAuction website or calling 877 361-7325.

The research bidding and final payment can all be done online. Find and bid on Residential Real Estate in Orange County NY. Unsure Of The Value Of Your Property.

May 4 2022 at 1201 pm. Box 1438 Santa Ana CA 92702-1438. May 11 2022 Notice of Tax Certificate Sale on the Internet Tax Deed Sales If the Tax Certificate is not redeemed within two years the certificate holder may file a Tax Deed Application.

Any properties not sold at the auction are turned over to the Real Property Tax Serv ice Department and a re sold on a monthly basis subject to the Finance Committee review see Left over List on the Deed Sale link. Up to 25 cash back Right to Redeem Your New York Home In a Tax Foreclosure. This rate includes any state county city and local sales taxes.

A filing fee is also required. Orange Ave Suite 310 Orlando FL 32801 Phone. The current sales tax is 8125 which is distributed as follows.

Address Phone Number and Fax Number for Orange County Recorder of Deeds a Recorder Of Deeds at Glenmere Cove Road Goshen NY. Orange County Recorder of Deeds Contact Information. Find All The Sale Information You Need Here.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. New York is an average state for tax lien certificate sales but New York does have excellent tax deed sales. In Orange County Tax Deed Sales are processed through the Orange County Comptrollers Office.

Current Properties for Auction Next Sale Date. Orange County Online Only Tax Foreclosure Real Estate Auction Closing at 1100 AM Thu May. US Sales Tax Rates.

To be posted soon Quick Links. Orange County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Orange County New York. Sales Tax Identification Numbers If you need a sales tax identification number in New York you must apply for it from the New York Department of Taxation and Finance.

Certain types of Tax Records are available to the. 2020 rates included for use while preparing your income tax deduction.

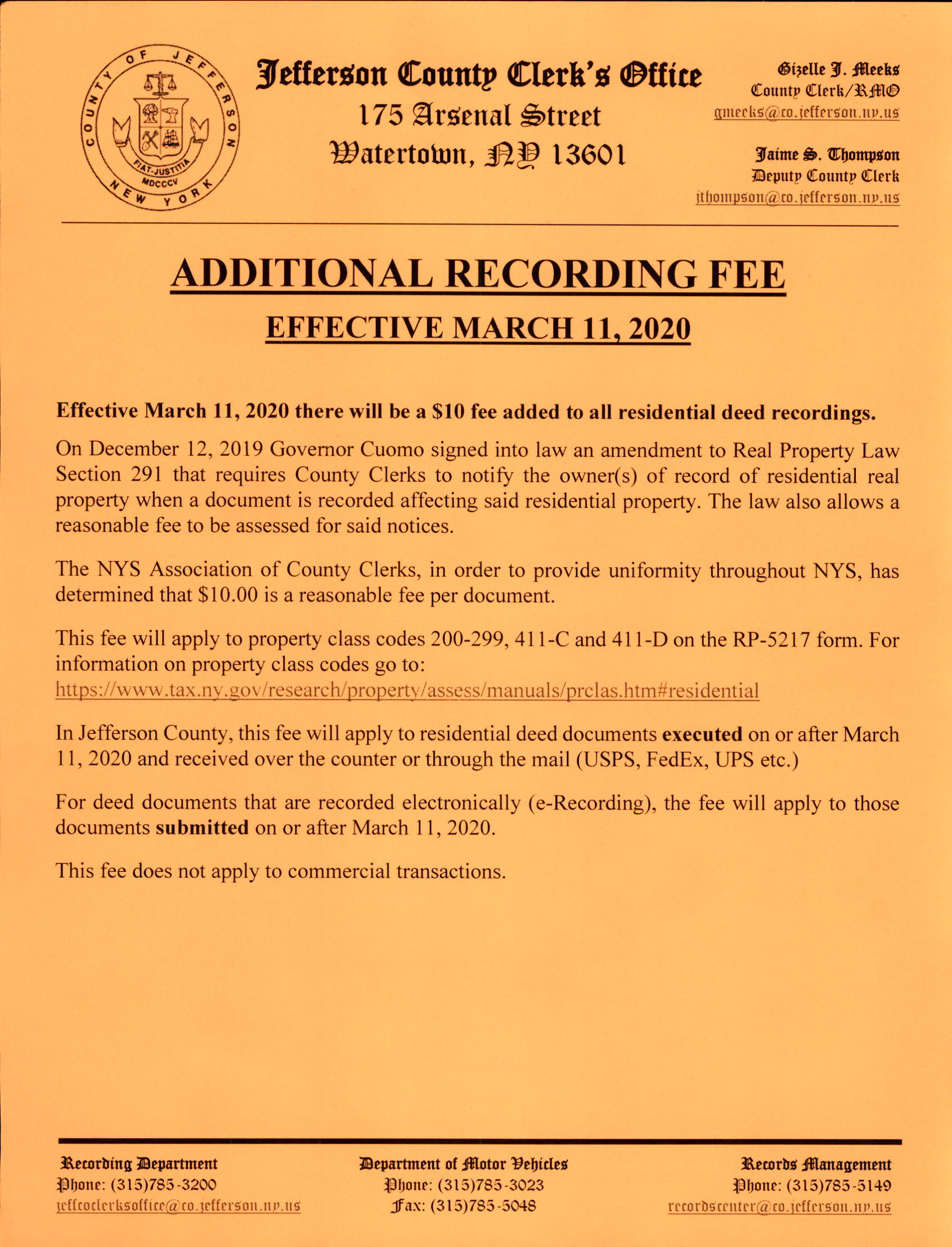

Welcome To Jefferson County New York Land Records

Orange County Florida Notice Of Contest Of Lien Download Fillable Pdf Templateroller

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Orange County Property Tax Oc Tax Collector Tax Specialists

Tax Deed Sales Phil Diamond Orange County Comptroller

Tax Certificate And Tax Deed Sales Pinellas County Tax

Parcel Information Orange County Ny

Online Records Orange County Ny

Sheriff S Sales Orange County Ny

Tax Deed Sales Phil Diamond Orange County Comptroller

Who Pays The Transfer Tax In Orange County California

Tax Deed Sales Phil Diamond Orange County Comptroller

Welcome To The Orange County Clerk S Office Orange County Ny